gerenme/iStock via Getty Images

This article was coproduced with Leo Nelissen.

When it comes to long-term investing, I love infrastructure.

I own three railroads covering Canada, all parts of the U.S., and Mexico.

I own Duke Energy (DUK), which is an electric utility company.

I have invested in Caterpillar (CAT), which provides equipment for infrastructure construction.

I own oil and gas companies and real estate stocks with storage portfolios. I also own Deere & Company (DE), which delivers the machines farmers require to produce food.

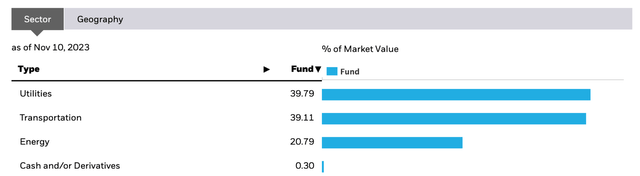

When looking at the holdings of the iShares Global Infrastructure ETF (IGF), we find that these are the biggest sectors:

- Utilities

- Transportation

- Energy.

iShares - IGF ETF

While none of these sectors are exciting compared to tech or growth investing, they come with a number of benefits, including that they allow investors to own critical parts of the (global) economy.

This is something mega entrepreneur Cornelius Vanderbilt understood.

"In the 1860s, America started building the first continental railroad. It provided a cheap and efficient way to transport products from one side of the country to the other.

One man in particular had a great impact on the industrialization of America, Cornelius Vanderbilt. Vanderbilt had a poor upbringing, but at the age of 16, he bought a ferry, and over the next 40 years, he built the largest shipping empire in the world.

Vanderbilt sold all of his ships and invested everything in railroads. He owned 40% of all the railroads in America, but he wanted them all. So, he closed down the Albany Bridge, creating a blockade prohibiting the rest of the railroad from entering the busiest port, New York City."

It's not just Vanderbilt.

Bill Gates has invested in Canada's largest railroad, Canadian National (CNI), while Buffett owns utility companies and the mega railroad BNSF.

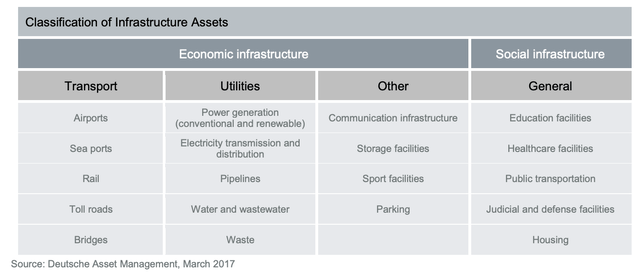

Although Deutsche Bank does not include energy in infrastructure, it does include a wide number of operations, including real estate and communications.

Then there's Bruce Flatt is CEO of Brookfield Asset Management (BAM), a leading global alternative asset manager with over $850 billion in assets under management.

He joined Brookfield in 1990 and became CEO in 2002. Under his leadership, he developed a global operating presence in more than 30 countries.

BAM

According to Forbes, Flatt "is one of the biggest and best investors you've likely never heard of."

He's worth $3 Billion according to Forbes, and "his winning deals include buying Olympia & York in 1996 and London's Canary Wharf in 2015 and recapitalizing General Growth Properties in 2010."

As per Forbes, "Flatt lives in a quiet Toronto neighborhood and often commutes by subway."

One of the company's within the Brookfield empire is known as Brookfield Infrastructure Corporation (NYSE:BIPC), which is the topic of this article.

Deutsche Asset Management

With that said, there are a number of benefits that come with investing in infrastructure.

- Stable and Predictable Cash Flows: Infrastructure assets often generate stable and predictable cash flows. This is because they typically involve long-term contracts or agreements that provide a reliable income stream for the companies.

- Essential Services: Many infrastructure assets provide essential services, making the demand relatively constant even during economic downturns.

- High Entry Barriers: Infrastructure projects often require significant capital investment and expertise, creating high entry barriers for new competitors. This can result in a more limited number of players in the market, reducing the risk of intense competition.

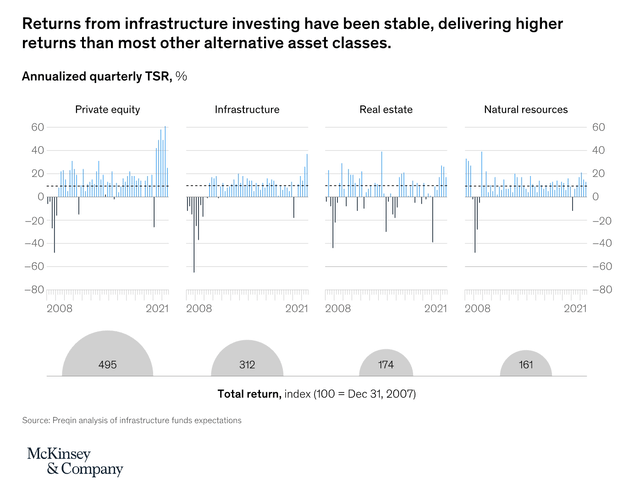

Hence, McKinsey writes that infrastructure investing has been a stable way of investing, with higher returns than most other alternative asset classes.

McKinsey & Company

However, they also write that investors need to be aware of disrupting trends.

"In the past, individual assets sometimes moved up or down the risk/return spectrum.

But with changes in energy, mobility, and digitization, more assets need to be reassessed: assets that have long dwelled squarely within an asset subcategory may need to move to a different bucket today, and there may be big shifts from super core all the way to core-plus.

Dramatic reshuffling is occurring because assets that were once seen as immutably stable, such as gas pipelines, are now exposed to significant energy transition risk."

That's where Brookfield Infrastructure comes in. It may be one of the best ways to gain access to well-diversified infrastructure, income, and potential outperforming capital gains!

The King Of Infrastructure Investing

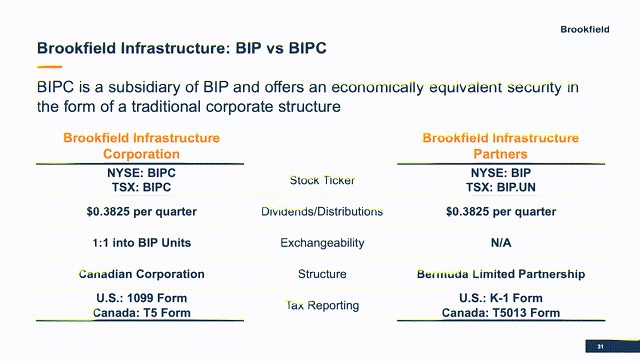

Before we get into the details, we are dealing with a company that can be bought via two different tickers. Brookfield Infrastructure Partners L.P. (NYSE:BIP) and the Brookfield Infrastructure Corporation (BIPC).

I use both tickers in this article, so please do not be confused.

Brookfield Corporation (BN), which is one of the world's largest asset managers, has applied a similar structure to its renewable energy business.

Essentially, there are three reasons why investors can pick between buying a partnership and a C-Corp.

- Brookfield is seeing higher demand from non-Canadian investors, which means it wants an option with a more favorable tax treatment.

- Institutions that cannot invest in partnership units get access to Brookfield's infrastructure assets.

- The company can be included in certain indices that usually do not include partnerships.

Having that said, the only difference is the tax situation. BIPC offers a 1099 Form. BIP investors in the U.S. are subject to a K-1 form.

The dividend distribution is the same.

Brookfield Infrastructure Corporation/Partners

So, everything I write with regard to BIPC also applies to BIP (and vice versa) unless it is something very tax-specific, as that's the only difference between the two tickers.

Having said all of this, BIPC is one of the best ways to get diversified infrastructure without buying an ETF.

The company's objective is to own and operate a globally diversified portfolio of high-quality infrastructure assets that will generate sustainable and growing dividends over the long term.

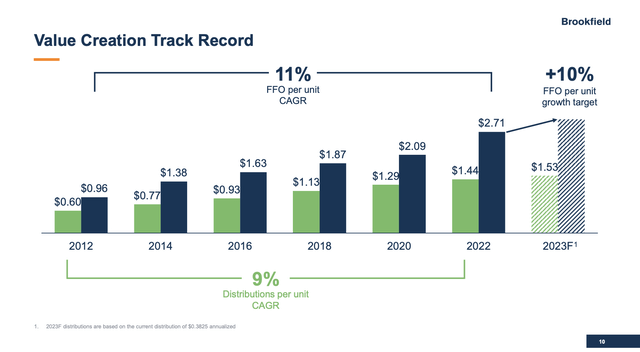

- The company has a >10% annual funds from operations ("FFO") growth target.

- It has a 5% to 9% annual dividend growth target.

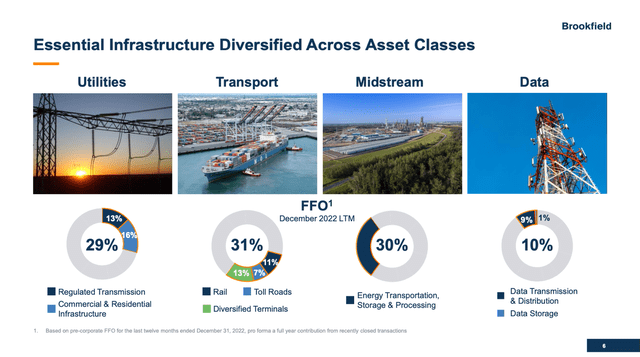

With regard to what we discussed in the first part of this article, the company owns assets in all the important sectors:

- Utilities

- Transportation

- Midstream (energy).

It has close to 30% FFO exposure in all of these sectors.

On top of that, it also has 10% exposure to data, including data transmission and storage (data centers).

Brookfield Infrastructure Corporation/Partners

Having said that, its portfolio, with an enterprise value of more than $40 billion, includes 62 thousand kilometers of electricity distribution and transmission lines, 4,200 kilometers of natural gas pipelines, 32 thousand kilometers of rail, 3.8 thousand kilometers of toll roads, 11 terminals, and two export facilities.

But wait, there's more!

It also owns close to 26 thousand kilometers of gathering, transmission, and transportation pipelines in its midstream segments.

It has 600 billion cubic feet of natural gas storage, more than 200 thousand telecom towers, two semiconductor manufacturing foundries, and 50 data centers, on top of fiber cables, natural gas liquids processing plants, and more.

As I explained in the first part of this article, these assets come with terrific benefits.

- 70% of its FFO has no volume or price exposure! This is driven by utilities (85%) and data (95%).

- 80% of its FFO is inflation-protected.

- 70% of its FFO is capable of growing pricing beyond inflation.

Thanks to these benefits, the company remains committed to shareholders.

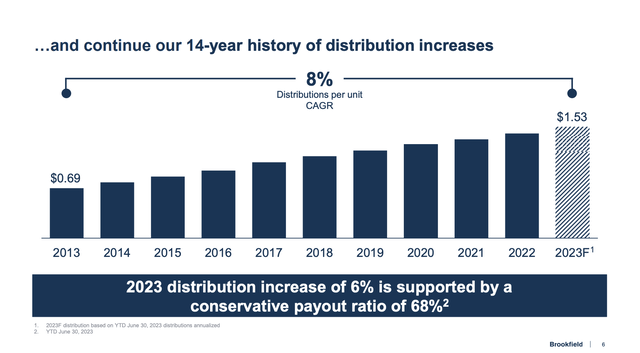

It does this by aiming to provide stable and growing distributions/dividends within the 5% to 9% range annually. The payout ratio is targeted between 60% and 70%, supported by a healthy balance sheet.

Going back to 2013, the company has hiked its dividend by 8% per year, maintaining a sub-70% payout ratio.

It currently pays an annualized dividend of $1.53, which translates to a 5.8% yield for BIP and 5.1% for BIPC.

Brookfield Infrastructure Corporation/Partners

Meanwhile, the company maintains a balance sheet with a BBB+ rating, which is one step below the A-range. 90% of its debt is long-term debt with a fixed rate.

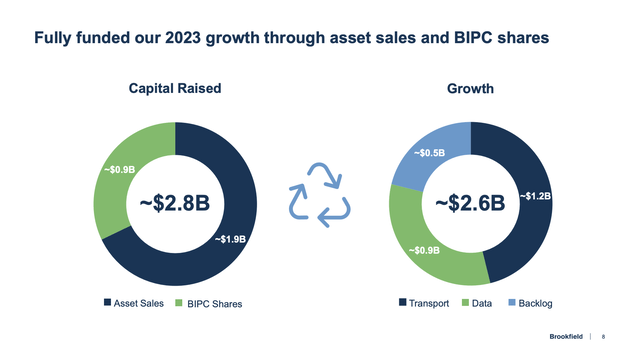

On top of that, it has $2.3 billion in liquidity and a capital recycling program that provides the company with sustainable growth options.

For 2024, the company is aiming for $2 billion in asset sales. This year, the company has funded most of its growth with asset sales, protecting investors against dilution and elevated rates.

Brookfield Infrastructure Corporation/Partners

When it comes to growth projects, the company focuses on the three D's.

- Digitalization

- De-globalization (shifting supply chains and trade flows)

- Decarbonization.

The company rightfully believes that trillions will be invested in these areas, creating significant demand for infrastructure.

When combining pricing power (higher margins), free cash flow reinvestments (internal growth), and GDP growth + secular growth, the company has fertile ground to achieve >10% annual FFO growth, which it has achieved going back to 2012.

Brookfield Infrastructure Corporation/Partners

With that in mind, getting a >5% yield, consistent dividend growth, a healthy balance sheet, and secular growth opportunities in a wide-moat business is great.

It also helps that the valuation has gotten very attractive.

Valuation

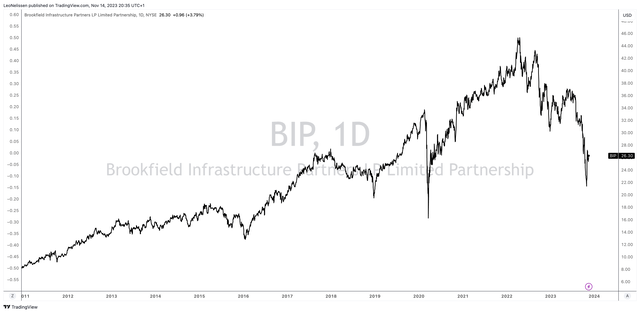

BIPC/BIP is currently trading more than 40% below its highs, which seems like a lot after all the positive details we just discussed.

TradingView - BIP

During its Q3 2023 earnings call, the company commented on this decline, including the factors that drove it.

The company noted that this trend is not unique, as utility infrastructure companies, in general, have faced similar challenges. Investors seem to be prioritizing credit or other sector strategies.

I agree with that, as investors shy away from businesses that require substantial investments to grow their moat. This also applies to BIP/BIPC.

However, the company maintains a very healthy balance sheet and has an efficient capital program that not only protects its dividend but also paves the way for investments in growth.

Hence, it's no surprise that the company is disappointed in the poor performance of its stock, especially because it maintains a strong long-term outlook.

The good news is that this opens up new opportunities for investors.

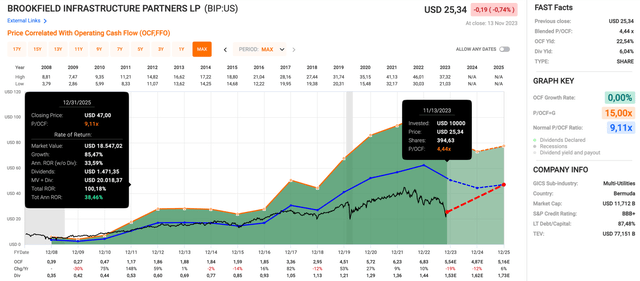

Using data in the chart below:

- BIP is currently trading at a blended P/OCF (operating cash flow) multiple of 4.4x.

- The long-term normalized multiple is 9.1x.

- This year, OCF is expected to decline by 19%, followed by a potential decline of 12% next year. In 2025, growth is expected to rebound by 6%.

- EBITDA (not visible in the chart) is expected to decline by 37% this year, followed by 14% growth in 2024 and 7% growth in 2025.

- A return to its normalized valuation by incorporation of expected OCF growth would result in a fair BIP (NY-listed) stock price of $47, which is close to its all-time high and 80% above its current price. The current consensus price target is $37.

FAST Graphs

I obviously cannot promise that BIP/BIPC won't fall any lower.

However, the risk/reward is really good at these levels.

If I didn't have so many single stocks in the infrastructure industry, I would be a buyer at these levels.

Although these stock market struggles aren't fun, buying top-tier infrastructure at great prices is how some of the world's most influential businessmen have made their money.

I have little doubt that this will continue to be the case, and although I'm just a small investor compared to the big guys, I am eagerly adding at these levels.

Takeaway

Investing in infrastructure, as exemplified by Brookfield Infrastructure Partners/Corporation, offers stability and growth potential.

BIPC, a global giant with a diverse portfolio spanning utilities, transportation, and data, boasts impressive financials - a BBB+ rating, a sustainable dividend yield of 5.1%, and a commitment to annual growth.

Despite market fluctuations, BIPC's undervaluation presents an enticing opportunity, supported by its robust long-term outlook and strategic focus on the three D's: Digitalization, De-globalization, and Decarbonization.

For investors seeking resilient returns, Brookfield Infrastructure stands out as a compelling choice in the infrastructure sector.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

"creation" - Google News

November 17, 2023 at 07:00PM

https://ift.tt/LpMxORA

Brookfield Infrastructure Stock: A Billionaire's Blueprint For Wealth Creation (NYSE:BIP) - Seeking Alpha

"creation" - Google News

https://ift.tt/jXObnQ2

https://ift.tt/VWduUpE

Bagikan Berita Ini

0 Response to "Brookfield Infrastructure Stock: A Billionaire's Blueprint For Wealth Creation (NYSE:BIP) - Seeking Alpha"

Post a Comment