Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

New members of the global super-rich gained more of their assets through inheritance than through wealth creation this year — the first time that this has been recorded by Swiss bank UBS in its nine years of surveying global billionaires.

A total of $141bn was amassed by 84 self-made billionaires around the world in 2023, while $151bn was passed on to 53 heirs, the bank’s research found.

“The heirs to billionaires are gaining prominence,” said Benjamin Cavalli, UBS’s head of global wealth management strategic clients. “New billionaires minted during this year’s study period accumulated more wealth through inheritance than entrepreneurship. That’s a theme we expect to see more of over the next 20 to 30 years, as more than 1,000 billionaires pass an estimated $5.2tn to their children.”

$151bnAmount inherited in 2023 by billionaires taking part in UBS survey

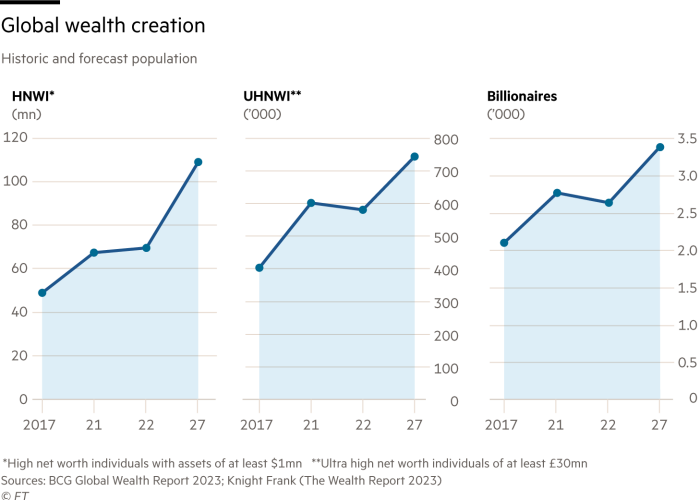

The study found that the number of billionaires worldwide rose from 2,376 to 2,544 in the 12 months to April 2023, with Europeans whose fortunes are linked to consumer-focused companies experiencing the strongest growth in assets. “The great wealth transfer is really gaining momentum now”, said Max Kunkel, chief investment officer for global family and institutional wealth at UBS.

But he added that the survey results also indicated a relative slowdown in wealth creation. “It suggests that it is more difficult to create wealth in an environment of high interest rates and economic/geopolitical uncertainty,” Kunkel added.

The findings come as the ‘great wealth transfer’ — from elderly baby boomers and Generation X to millennials and younger — continues. Research firm Cerulli Associates estimates that some $73tn will be inherited by 2045 in the US alone.

The UBS study also found that 62 per cent of billionaires cited ‘geopolitics’ as their biggest business concern, above inflation and the possibility of a US recession. However, Kunkel noted that first and second-generation billionaires had different fears about the outlook, with first-generation wealthy more focused on the potential for a US recession and other immediate threats.

Another generational split emerged in billionaires’ preferred asset classes. Older investors were more likely to plan to expand their range of investments into fixed income and private credit, while younger investors remained keener on public and private equity.

“Among our older billionaire investors, there is a focus on income generating assets, fixed income and also private credit,” Kunkel said. “Anecdotally, it’s on the very high quality part of private credit. The next generation is thinking more about long term risk; geopolitical and innovation.”

Commenting on the survey, Matthew Fleming, partner at London-based wealth manager Stonehage Fleming, said: “It’s possible that this period of great wealth creation is over.”

He added that Stonehage Fleming’s own client research chimed with some of UBS’s results. Geopolitics was at the forefront of ultra-high-net-worth individuals’ investment decisions, while younger elites were more likely to consider the societal impact of their assets than their parents.

“It’s a good thing that responsible custodians are taking on great wealth at this time”, he said. “The key is to make sure that the next generation is properly prepared to handle the responsibility.”

"creation" - Google News

November 30, 2023 at 08:35PM

https://ift.tt/yG9wpER

Billionaires amass more through inheritance than wealth creation, says UBS - Financial Times

"creation" - Google News

https://ift.tt/R8LZPY4

https://ift.tt/nGJHyRq

Bagikan Berita Ini

0 Response to "Billionaires amass more through inheritance than wealth creation, says UBS - Financial Times"

Post a Comment