Summary

- Delta Air Lines achieved strong operational and financial performance in 2023, with an operating revenue of $14.2 billion in the last quarter and a total year revenue of $58 billion.

- Premium travel demand drove revenue growth, outperforming the main cabin, and loyalty revenue improved by 11% compared to the previous year.

- International passenger numbers grew significantly, especially in transatlantic, trans-Pacific, and Latin American travel.

Skyteam partner Delta Air Lines is celebrating its strong December quarter and finishing the year with leading operational and financial performance. The carrier, which had an operating revenue of $14.2 billion in the last quarter of 2023, added to the total year numbers of $58 billion.

Demand for premium travel saw revenue grow 15% in this sector, outperforming the main cabin. Loyalty revenue improved by 11% compared to 2022.

The figures

Announced on January 12th, the full-year financial results for Delta saw an operating income of $5.5 billion, sitting at an operating margin of 9.5%, pre-tax; this sat at $5.6 billion, at a margin of 9.7%. Payments on the carrier's debt and lease obligations were $4.1 billion, leaving the total debt for the carrier sitting at $20.1 billion at the end of 2023.

International passenger numbers continue to grow, with demand 25% higher than in the last quarter of 2022. Double-digit revenue and capacity have been seen in transatlantic, trans-Pacific, and travel to Latin America, where remuneration from American Express rose to $1.7 billion, 11% higher than the previous year.

Diversified revenue streams for the carrier, which included loyalty, premium, cargo, and MRO, accounted for 55% of Delta's total revenue.

Delta's chief executive officer, Ed Bastian, was quoted as saying the following as part of a company statement:

“2023 was a great year for Delta with industry-leading operational and financial performance. Our people and their commitment to deliver unmatched service excellence for our customers is at the foundation of Delta’s success. We are thrilled to recognize their outstanding work with $1.4 billion in profit sharing payments next month. In 2024, demand for air travel remains strong and our customer base is in a healthy financial position with travel a top priority. We expect to grow full year earnings to $6 to $7 per share and generate free cash flow of $3 to $4 billion, further strengthening our financial foundation.”

Analyzed: Delta Air Lines’ Top 10 Airports In Early 2024

The airline is the largest carrier at seven of its top 10 airports.High holiday volumes

Taking off with Delta to somewhere exotic has seen the airline achieve its highest quarter volumes for leisure travel. In contrast, corporate travel started to ramp up by year-end, adding double-digit growth year-on-year.

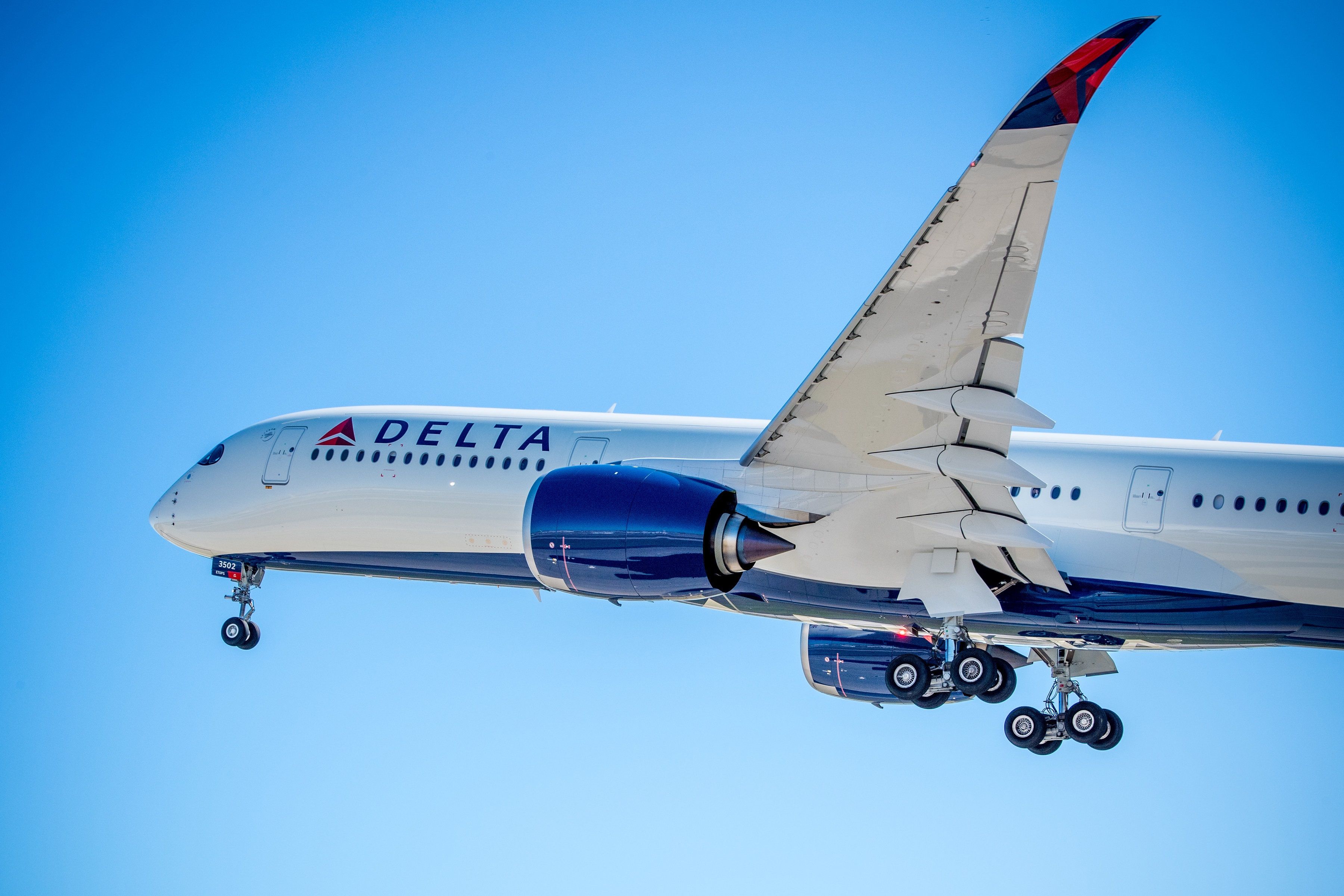

20 A350-1000s

Delta Air Lines has confirmed that it has ordered 20 A350-1000 aircraft from Airbus as it continues renewing its twin-aisle jet fleet with new, more fuel-efficient aircraft. While the carrier has yet to operate the A350-1000, it currently operates 28 A350-900s, with eight more still on order.

According to Delta Air Lines, the Airbus A350-1000 will be used primarily for long-haul flights from the airline’s main international hubs, supporting its global expansion while replacing older aircraft and fueling the carrier’s growth. The A350-1000's size will mean more premium seats, including Delta One Suites and Delta Premium Select.

Were you at all surprised by Delta's latest report on its performance? Share your thoughts by leaving a comment!

"loyalty" - Google News

January 13, 2024 at 10:00AM

https://ift.tt/GbpYfBd

Strong Sales In Premium & Loyalty Pushes Delta Air Lines To Record Earnings - Simple Flying

"loyalty" - Google News

https://ift.tt/bTJAHNl

https://ift.tt/fY9c4Jq

Bagikan Berita Ini

0 Response to "Strong Sales In Premium & Loyalty Pushes Delta Air Lines To Record Earnings - Simple Flying"

Post a Comment