Since 2018 Mando-Connect and YouGov have worked together to explore and understand the loyalty industry in Britain. They are proud this year to publish the most comprehensive white paper yet: “What the British want from Loyalty programmes 3.0”. As Britain is one of the most sophisticated and diverse loyalty markets in the world, we at The Wise Marketer keep a close eye on the study and every year it’s published we share the highlights (check out here for the 2020 and here for the 2018 highlights.

By: Charlie Hills, Mando-Connect

In the last 2 years the world has dramatically changed, so it’s more important than ever that we, as strategic loyalty marketers, focus on understanding what our audiences really want from loyalty programmes and how we can improve what we do. This year’s study taught us a lot.

Here are 6 big insights we took out from the report.

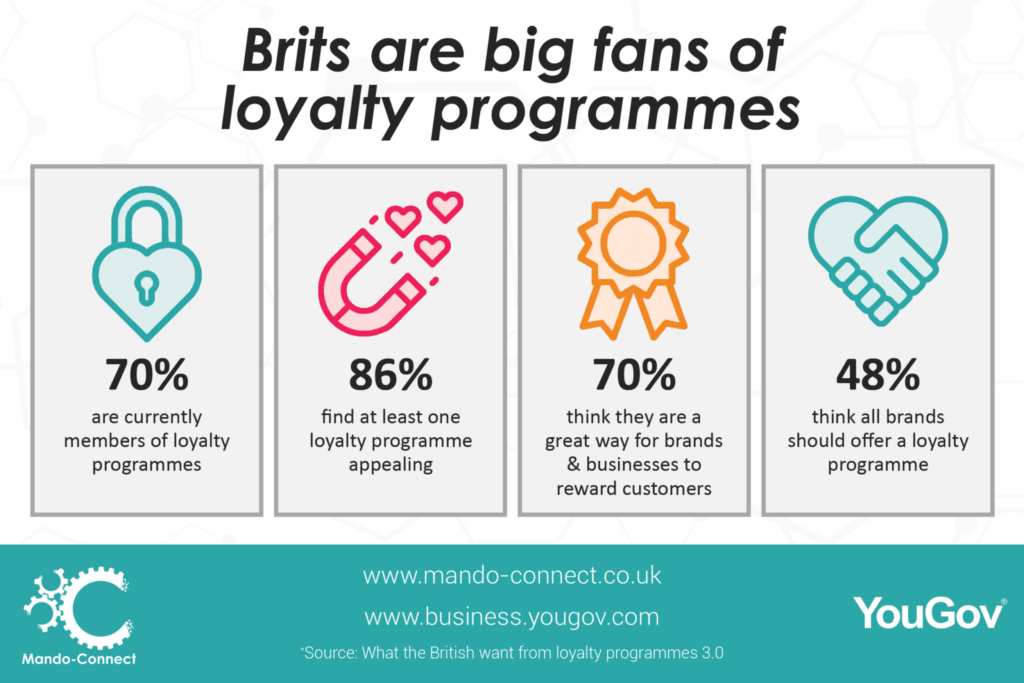

1) Despite everything that has changed, the British remain big fans of loyalty programmes and are highly engaged with the sector

- 70% are currently members of loyalty programmes

- The average Brit is a member of 4 programmes

- 86% find at least one loyalty programme appealing

- 70% think loyalty programmes are a great way for brands and businesses to reward customers

- 48% think all brands should offer a loyalty programme

The majority of British adults are members and fans of loyalty programmes. The level of engagement and popularity that the industry experiences is a testament to the investment that British loyalty programmes have made in understanding and then offering Brits what they want. However, it’s not all good news; we are starting to see small declines in the numbers, no doubt driven by the changing British lifestyles and the impact that the pandemic has had on the ability of many sectors to attract and engage members during the last 2 years. We will be keeping a close eye on the trend and anticipate an uplift as the world starts to reopen and programmes have more opportunity to engage with their membership.

Key Take-Out: Brits are highly engaged with the loyalty industry, but we need to keep a close eye to ensure we reverse the slight decline of recent years.

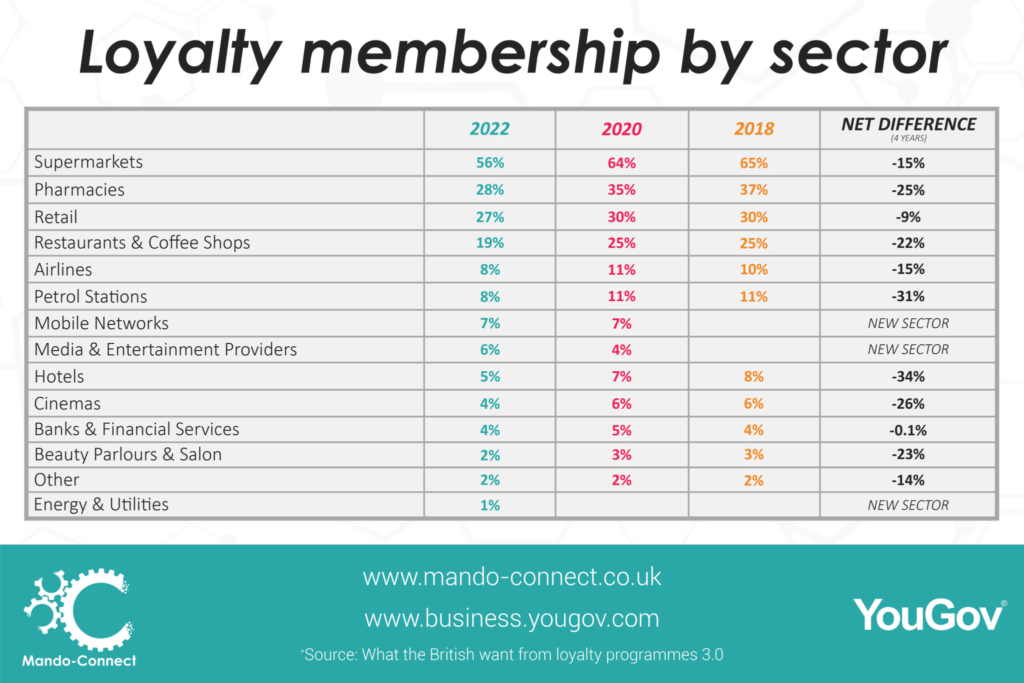

2) The British Loyalty Industry is dominated by supermarkets, pharmacy and retail programmes.

- 56% of Brits are members of a supermarket loyalty programme

- 28% are members of a pharmacy loyalty programme

- 27% are members of a retail loyalty programme

The biggest 3 sectors are also home to some of the biggest programmes and the biggest news. The biggest programmes in the supermarket sector are Tesco Clubcard, Nectar from Sainsbury’s and Sparks from Marks & Spencer’s. Boots Advantage Card is still the biggest in pharmacy and Amazon Prime dominates in retail. In the last 2 years we have seen a lot of innovation in these big sectors too. Lidl Plus launched in September 2020. It has successfully disrupted the sector rules, offering “Big Savings, No Fuss, that’s Lidl Plus.” There’s no points, no card and no complexity. We wrote a piece on its launch back in March. Tesco Clubcard has been busy too — the launch of Clubcard Prices (where members get cheaper prices than non members) and Clubcard Plus (a new subscription loyalty programme where, for £7.99 a month, members get benefits like 10% off groceries in-store twice a month, double data on Tesco Mobile, and 10% off brands like F&F.

Key Take-Out: Supermarkets, Pharmacy and Retail programmes dominate the British loyalty landscape. The sectors have seen some explosive innovation in the last 2 years including the rise of members-only pricing and new subscription models. Where they lead will others follow?

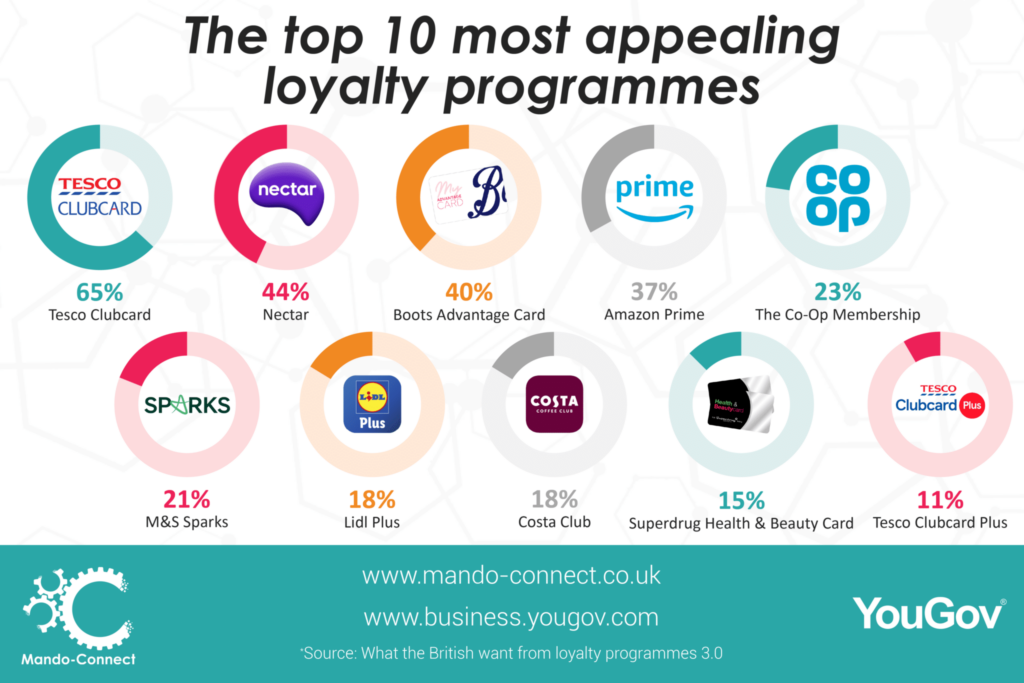

3) The most appealing programmes in Britain are from Supermarkets, Pharmacies, Retail and Coffee Brands.

Title: The Most Appealing Loyalty Programmes in Britain Are:

- Tesco Clubcard 65%

- Nectar 44%

- Boots Advantage Card 40%

- Amazon Prime 37%

- The Co-Op Membership 23%

- M&S Sparks 21%

- Lidl Plus 18%

- Costa Club 18%

- Superdrug Health & Beauty Card 15%

- Tesco Clubcard Plus 11%

It turns out size does matter… the most popular programmes are also the biggest. Of the top 10, it’s interesting to see that 3 are “new news” and Lidl Plus and Tesco Clubcard Plus are fairly new entrants to the market, both with disruptive models. And Costa Club has newly relaunched in Britain. It has ditched points (like many programmes we’ve written about before including Shell Go+ and M&S Sparks) and moved to a simplified milestone model instead. Members earn ‘beans’ every time they purchase a drink, 8 beans gets you a hot drink — and if you use a reusable cup, you only have to buy 4 drinks to get one free. This new focus on sustainability has won many plaudits for the programme in both the consumer and loyalty space.

Key Take-Out: Size does matter; the biggest programmes are also the most appealing. The top 10 list does demonstrate how much Brits like positively disruptive programmes; 3 of the top 10 are new or recently launched programmes doing things differently.

4) Rewards are the most important thing to get right in loyalty

We have learned in previous iterations of the research that the no 1 thing Brits want from their loyalty programme is great rewards and in 2022 the picture is no different.

- Rewards are no 1 for getting Brits to join programmes (60% join for discounts and offers, 28% for partner rewards and 23% for free products, services, experiences and privileges)

- Rewards are also no 1 for maintaining usage and engagement (52% will keep loving and using a programme if it offers them good offers, rewards and benefits that are always changing and updating, 44% will stay engaged for a consistent version of the same).

Brits are also very clear about what types of rewards they want. As in previous years, partner rewards are more popular than offering rewards from your own brand. And Brits love rewards from big well-known brands (48%), from British brands (28%), from established brands (20%), from value-focused brands (19%), from practical brands (17%), from brands that help charities and good causes (17%), and from brands that help the environment (15%). The range of emotions that drives reward preference is still diverse — the top 3 driving emotions are savviness, treat-me and altruism.

Key Take-Out: Getting your rewards right remains the no 1 priority for loyalty programmes everywhere. Take the time to understand what your members and prospects really want. And then invest to deliver the right rewards to the right people. One size does not fit all.

5) The future of rewards is exciting

For the first time we asked Brits about what rewards they want to see in the future. The industry is very focused on this, but the majority of Brits haven’t yet caught up. When offered a list of exciting new reward ideas, 63% of Brits said they weren’t interested in receiving any of them.

But we do see an ‘early adopter’ mindset in about 10% of Brits. Reward concepts like connected tech and smart devices, personal carbon offsetting, personalised healthcare, or tech and cryptocurrency are appealing to 10% or more. NFTs, despite the hype, only appeal currently to 4%.

Key Take-Out: Invest in rewards of the future, but ensure you are targeting them for members with an early adopter mindset.

6) The majority want programmes to help people live more sustainably or help the environment

71% of Brits think loyalty programmes should help people live more sustainably or support the environment.

- 44% want programmes to reward sustainable or environmentally friendly behaviours

- 43% want rewards that help people live more sustainably

- 39% want programmes to support environmental charities

- 33% want to be offered rewards from brands that actively help the environment

- 26% want programmes to offset the carbon so the programme is carbon neutral

- 20% want information about the environment and sustainability

- 8% want community forums so that members can discuss issues and suggest solutions

Sustainability is a very important priority for consumer, society, and political agendas. The world watched COP26 and demanded more. Loyalty programmes need to look at what more they can do to support — thinking beyond just supporting environmental charities. TK Maxx & Homesense Treasure is a great example of a programme doing more. Treasure offers members (amongst others) everyday sustainable rewards such as a beeswax wraps, cool re-usable pocket shopping bags and scented shampoo bars, all offered for members to enjoy and prevent single use waste.

Key Take-Out: Every programme needs to have sustainability and helping the environment as a key objective. What can you do to make a difference?

This year’s research was fascinating to read. As well as the above key insights we learned that the impact of loyalty programmes has increased significantly — loyalty programmes in Britain are positively impacting loyalty, spend, recommendation, emotional connection, appeal and frequency. We learned who engages and who doesn’t, which loyalty mechanics are the most appealing and more. To download the full white paper please visit www.mando-connect.co.uk.

Charlie Hills is the Managing Director & Head of Strategy at Mando-Connect, a Certified Loyalty Marketing Professional™, and a featured contributor to The Wise Marketer. All figures unless otherwise stated are from YouGov PLC.

"loyalty" - Google News

April 14, 2022 at 01:42AM

https://ift.tt/xtfQ2vB

New Research From the UK: What the British Want From Loyalty Programmes 3.0 - TheWiseMarketer.com

"loyalty" - Google News

https://ift.tt/ua2lQRE

https://ift.tt/gZ7UjfT

Bagikan Berita Ini

0 Response to "New Research From the UK: What the British Want From Loyalty Programmes 3.0 - TheWiseMarketer.com"

Post a Comment