Robinhood has made it big by persuading a new generation of investors to have a go at trading. Now it just has to convince the successful ones to stick around.

The US-based broker listed its shares last month, capitalising on a flood of demand for a commission-free app that made stock trading so easy it has been compared to a game. Last week Robinhood shares soared 50 per cent in a day, a move that evoked volatile “meme stocks” such as GameStop that have been popular among its customers.

Whether Robinhood can attract stable, long-term investors will be critical to its future revenue growth. But customers, analysts and rivals say it has a long way to go.

The most important money in the brokerage sector is “sticky” money, or long-term capital that brokers can count on staying with their platform, rather than lost in risky bets or transferred away.

Asset accumulation is essential to the rapid growth that Robinhood’s institutional backers are wagering on, especially with the prospect of lower trading volumes as investors find other things to do in the later stages of the pandemic.

However, Robinhood may struggle to shed its association with “gamifying” investing. Customers interviewed by the Financial Times noted that Robinhood is where they play around, while they hold their larger and less actively traded investments elsewhere.

“The money I have on Robinhood I view as ‘whatever happens, happens’,” said Nick Hogan, a Los Angeles entertainment manager who has long traded on Robinhood. “If [my investment] crashes, it doesn’t affect me that much. It’s like money you would use at a casino.”

Daniel Kaneb, an analyst for a natural gas company in Colorado, said he used “Robinhood very much for fun”. But he said he used Boston-based Fidelity, a fund manager and discount broker, “for anything ‘real’, like most of my mutual funds”.

“The institutional basis of Fidelity makes it less . . . meme-like. I know it’s going to be there tomorrow,” Kaneb said.

Other customers said they viewed their Robinhood accounts like those on sports betting sites, having turned to stocks when live sports were cancelled during the early stages of the pandemic.

Some brokers have reported seeing customers who had gained comfort with financial markets through Robinhood decide to add a more established institution.

Thomas Peterffy, the founder and chair of Interactive Brokers, told the FT that he saw large account transfers of between $50,000 and $100,000 invested coming over from Robinhood. “Every day we see maybe 10 accounts come to Interactive Brokers from Robinhood. In a year and a half, I’ve only seen one go the other way,” Peterffy said.

Walter Bettinger, chief executive of the discount broker Charles Schwab, told analysts last month that younger customers may use one brokerage for a given kind of trading, “but then they also have an account at Schwab where their real money resides”.

Robinhood’s success with young investors and the surge of retail trading has pushed a cohort of investors into the market that the industry was not expecting for another 10 years, analysts said. However, “the competition is going to be what happens when these young clients get wealthier”, said one industry analyst.

When Robinhood pushed the industry to drop commissions on trading in late 2019, diverse revenue streams that customers pay for, such as advice, savings products and retirement planning, became more essential for survival. Trading-only platforms such as TD Ameritrade were swiftly consolidated.

Diversified offerings “are table stakes to see long-term capital moving your way”, said Alois Pirker, wealth management research director for the Boston-based research firm Aite-Novarica. And despite runaway success in repopularising investing with younger and lower-income customers, “Robinhood hasn’t done anything to that effect. They are still very much about trading,” Pirker said.

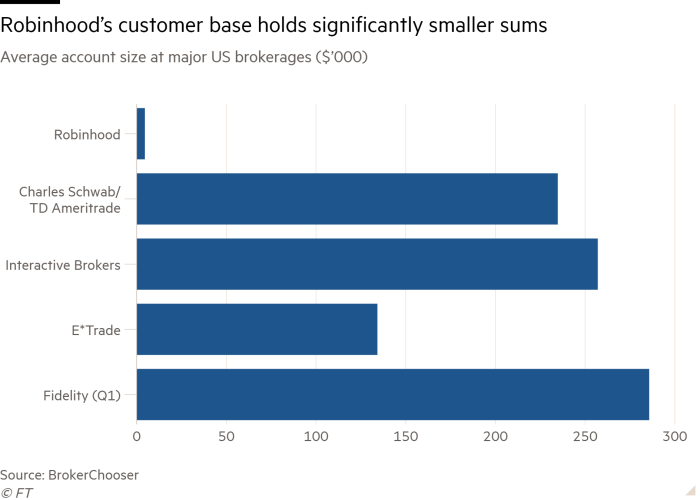

Vlad Tenev, Robinhood’s co-founder, testified to the House of Representatives financial services committee in February that the average account size on Robinhood was about $5,000, while the median account size was only $240. The average account size for customers under 30 years old at Charles Schwab is five times larger at $25,000.

At ETrade, a subsidiary of Morgan Stanley, the average account size is more than $130,000, according to the research firm BrokerChooser.

In the three months to March 31, as Robinhood was criticised during the GameStop meme stock rally for its decision to halt trading during periods of high volatility, the broker lost more than $4.1bn in assets from 206,000 accounts transferring off its platform, according to a filing for its initial public offering. The broker earned more than $12.5m in fees from charging users to move accounts to other brokerages over the same period.

Robinhood said: “The majority of our customers prefer to buy and hold,” adding: “It’s never been easier or more delightful to build a portfolio and invest for the long term.”

The broker pointed to presentations it gave around the time of its IPO that said it was a “safety first” company and was investing in building stability on its platform as well as in investor education.

Robinhood changed the market, experts said, and now almost every major brokerage matches its offering of commission-free trading. The question is whether Robinhood can change how it is perceived by that market.

“Robinhood came in and made it super-easy to trade from your smartphone . . . but on the other hand there is certainly the sense that this all seems connected to a game,” said Itay Goldstein, a professor of finance at Wharton Business School in Philadelphia.

He added: “Robinhood has potential to tap into a market that was untapped before, but they also have to steer away from those things that are not serious and detached from fundamentals.”

"loyalty" - Google News

August 10, 2021 at 05:18PM

https://ift.tt/3s5ZPWL

Robinhood’s growth hinges on loyalty of next-gen traders - Financial Times

"loyalty" - Google News

https://ift.tt/2VYbPLn

https://ift.tt/3bZVhYX

Bagikan Berita Ini

0 Response to "Robinhood’s growth hinges on loyalty of next-gen traders - Financial Times"

Post a Comment